Shareholder activism

- Marc Allen

- Aug 15, 2017

- 4 min read

In Australia, the Commonwealth Bank spent quite a bit of time in the headlines this week. There was one news story however that got lost amongst the other big stories. This week, proceedings were filed in the Federal Court of Australia on behalf of two Commonwealth Bank shareholders. The shareholders allege that the bank has failed to adequately disclose climate change risk in its 2016 annual report. They are also seeking an injunction to prevent these omissions in future annual reports. The physical and transition risks associated with climate change, it is alleged, present material risks to the bank and, as such, should be disclosed in their annual report.

Geoff Summerhayes, executive board member of the Australian Prudential Regulation Authority (APRA) - which oversees Australia's financial services industry - presented a speech on climate risk to the insurance council of Australia in February of this year. This speech discussed how climate risk is no longer a future or a non-financial problem. He stated, "some climate risks are distinctly ‘financial’ in nature. Many of these risks are foreseeable, material and actionable now. Climate risks also have potential system-wide implications that APRA and other regulators here and abroad are paying much closer attention to". Linked to this is a legal opinion from Noel Hutley SC from Minter Ellison where he states "it is conceivable that directors who fail to consider climate change risks now could be found liable for breaching their duty of care and diligence in the future". The opinion also makes it clear that climate change risks are entirely foreseeable at the present time. These are some of the external factors that have led to the Commonwealth Bank proceedings. It will obviously remain to be seen what happens with this case but it is clear that this case will be watched closely by other listed companies with significant exposure to this risk.

Shareholder activism via shareholder resolutions at annual general meetings is one way of shareholders engaging with companies and their response to climate risk (another way is to merely divest shares or follow the example of the Commonwealth Bank shareholders above). Introducing shareholder resolutions to be voted on at meetings has been increasingly utilised in recent years. The Ceres group (https://www.ceres.org) tracks shareholder resolutions that are brought forward by its investor network, as well as the results of the votes when these resolutions are voted on.

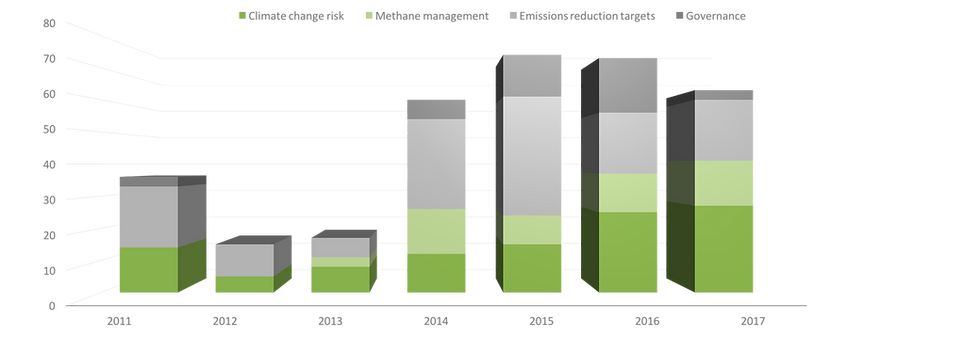

Using the shareholder resolutions database, some data analysis has been completed that shows the trend of shareholder resolutions over time. To create this dataset, the shareholder resolutions were filtered and only resolutions relating directly to climate change were examined. A chart showing the trend in total shareholder resolutions from 2011 to 2017 is presented below.

In the chart, the darker grey represents the number of climate change related resolutions that were successful when voted on. The darker green sections represent those shareholder resolutions that were withdrawn as the company committed to address the resolution without having a vote. It can be seen that the total number of resolutions being voted on has been increasing year on year (2017 resolutions are for the year to date). This is reflective of increased interest from shareholders and the general public on company responses to climate change. However, as companies are starting to volunteer information pre-emptively, the number of shareholder resolutions required may start to taper off and even reduce over time. The decision on whether to pre-emptively disclose information or not is one for the board of that company to make though there are social license implications that should be considered.

The following chart, also derived from the Ceres dataset, shows the type of shareholder resolutions that have been brought to companies over time.

It is clear that underpinning the overall increase in shareholder resolutions, is an increase in the number that relate specifically to climate change risk. Management of methane has also become more important to shareholders in recent years. This is reflective of the current narrative on climate change which is first and foremost a discussion on potential financial risk to companies from climate change. The focus on methane appears largely from a focus on the fugitive emissions associated with hydraulic fracturing activities and tight gas development. There have been studies that show the advantage of natural gas over coal on a life cycle emissions basis may be eroded if fugitive and vented emissions are high - shareholders are therefore interested in understanding the exposure of tight gas developers to this risk.

It is clear that there is an increasing trend for this sort of shareholder activism. As mentioned previously, it is a board decision whether to disclose climate change risk prior to a shareholder resolution being introduced or not. Without pre-emptive disclosure, there is a reasonable likelihood that a company with significant exposure could see some sort of shareholder resolution introduced.

What should be done however, is an exercise to understand a company's exposure to this risk. Scenario analysis, where company performance against different climate change action scenarios should definitely be completed so at least the board understands what risk they may be exposed to. Of most importance is developing an understanding of what the business looks like in a climate change scenario that matches the ambitions of the Paris Agreement - a temperature rise of well below 2 degrees C. With a deep understanding of the exposure to climate change risk, strategies to manage this risk can be put in place.

Comments